Strong Assistance: Trust Foundations You Can Depend On

Strong Assistance: Trust Foundations You Can Depend On

Blog Article

Enhance Your Heritage With Expert Trust Fund Structure Solutions

In the realm of legacy preparation, the importance of developing a strong structure can not be overstated. Expert count on foundation options provide a robust structure that can safeguard your possessions and ensure your dreams are performed precisely as planned. From decreasing tax responsibilities to choosing a trustee who can capably manage your affairs, there are essential considerations that demand focus. The complexities entailed in count on structures necessitate a critical technique that straightens with your long-lasting objectives and worths (trust foundations). As we delve right into the nuances of count on structure solutions, we discover the crucial elements that can fortify your heritage and provide a long-term influence for generations ahead.

Benefits of Depend On Foundation Solutions

Trust foundation remedies use a robust framework for safeguarding assets and ensuring lasting monetary security for people and organizations alike. One of the primary advantages of trust fund structure solutions is property security.

Via trust funds, individuals can detail just how their possessions should be handled and dispersed upon their passing away. Trusts additionally provide privacy benefits, as possessions held within a trust fund are not subject to probate, which is a public and often extensive lawful procedure.

Types of Depends On for Heritage Preparation

When considering tradition planning, a critical facet involves discovering various kinds of lawful tools developed to protect and distribute properties successfully. One typical sort of trust made use of in tradition planning is a revocable living trust fund. This trust fund enables individuals to keep control over their possessions during their life time while making sure a smooth shift of these assets to recipients upon their death, avoiding the probate procedure and offering privacy to the family members.

An additional type is an unalterable depend on, which can not be altered or withdrawed once developed. This trust fund supplies prospective tax benefits and safeguards assets from lenders. Charitable counts on are likewise prominent for individuals wanting to support a cause while keeping a stream of revenue for themselves or their beneficiaries. Unique requirements trusts are necessary for individuals with disabilities to guarantee they get necessary treatment and support without threatening federal government benefits.

Understanding the various sorts of trusts offered for legacy preparation is important in creating a comprehensive approach that aligns with individual objectives and priorities.

Selecting the Right Trustee

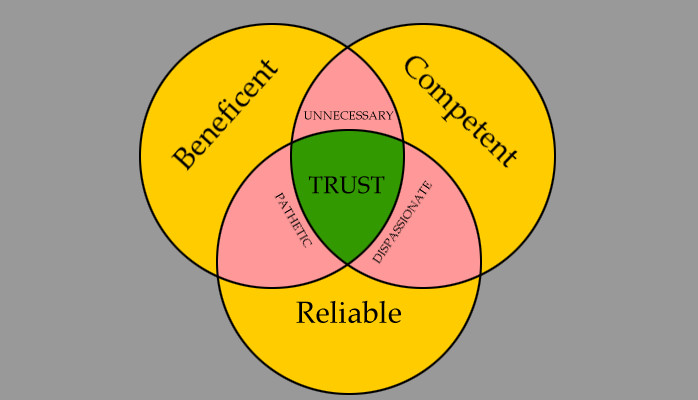

In the world of tradition preparation, a crucial facet that requires careful consideration is the choice of a proper person to fulfill the pivotal role of trustee. Picking the appropriate trustee is a decision that can considerably affect the effective execution of a depend on and the fulfillment of the grantor's desires. When choosing a trustee, it is necessary to prioritize qualities such as dependability, economic acumen, stability, and a commitment to acting in the very best passions of the beneficiaries.

Preferably, the chosen trustee must have a solid understanding of monetary issues, be capable of making sound financial investment choices, and have the ability to navigate intricate legal and tax obligation requirements. By very carefully read what he said thinking about these variables and selecting a trustee that straightens with the values and goals of the depend on, you can aid guarantee the lasting success and preservation of your legacy.

Tax Obligation Ramifications and Advantages

Thinking about the fiscal landscape bordering trust fund structures and estate preparation, it is paramount to look into the detailed realm of tax effects and advantages - trust foundations. When establishing a depend on, understanding the tax ramifications is vital view website for enhancing the advantages and decreasing possible responsibilities. Trusts provide various tax advantages depending on their framework and objective, such as lowering estate tax obligations, revenue tax obligations, and present tax obligations

One considerable benefit of specific count on structures is the ability to transfer assets to beneficiaries with reduced tax obligation effects. For instance, unalterable trust funds can get rid of properties from the grantor's estate, possibly reducing estate tax obligation. Furthermore, some counts on allow for income to be dispersed to recipients, that may be in lower tax obligation braces, leading to overall tax obligation financial savings for the household.

Nonetheless, it is essential to keep in mind that tax legislations are intricate and subject to alter, emphasizing the need of consulting with tax obligation experts and estate preparation professionals to ensure conformity and maximize the tax advantages of count on structures. Correctly browsing the tax effects of trusts can result in considerable financial savings and a more reliable transfer of wealth to future generations.

Steps to Developing a Count On

The initial step in establishing a look at here now count on is to plainly specify the function of the depend on and the properties that will certainly be included. Next, it is important to pick the type of depend on that ideal aligns with your goals, whether it be a revocable depend on, unalterable trust fund, or living trust.

Verdict

To conclude, establishing a count on foundation can offer various benefits for tradition planning, including asset protection, control over circulation, and tax obligation benefits. By selecting the proper kind of trust fund and trustee, individuals can protect their possessions and ensure their wishes are brought out according to their wishes. Understanding the tax implications and taking the necessary actions to develop a depend on can assist strengthen your legacy for future generations.

Report this page